How Clark Wealth Partners can Save You Time, Stress, and Money.

The Definitive Guide to Clark Wealth Partners

Table of ContentsIndicators on Clark Wealth Partners You Should KnowLittle Known Facts About Clark Wealth Partners.The Best Strategy To Use For Clark Wealth PartnersIndicators on Clark Wealth Partners You Should KnowThe Single Strategy To Use For Clark Wealth PartnersSome Known Details About Clark Wealth Partners Getting My Clark Wealth Partners To Work

The globe of finance is a difficult one. The FINRA Structure's National Capability Research Study, for instance, just recently found that almost two-thirds of Americans were unable to pass a basic, five-question economic literacy test that quizzed participants on subjects such as passion, financial debt, and various other relatively standard ideas. It's little wonder, after that, that we typically see headlines regreting the bad state of a lot of Americans' funds (financial advisors illinois).Along with handling their existing clients, financial advisors will frequently invest a reasonable amount of time every week conference with possible customers and marketing their services to preserve and expand their service. For those thinking about becoming an economic consultant, it is crucial to think about the average salary and task stability for those operating in the area.

Programs in taxes, estate preparation, investments, and threat management can be handy for pupils on this course. Depending upon your unique career goals, you may additionally need to make particular licenses to satisfy certain clients' requirements, such as acquiring and selling stocks, bonds, and insurance policies. It can likewise be practical to gain an accreditation such as a Qualified Economic Organizer (CFP), Chartered Financial Analyst (CFA), or Personal Financial Specialist (PFS).

The Best Guide To Clark Wealth Partners

Lots of people decide to obtain aid by using the services of a financial expert. What that resembles can be a number of points, and can differ depending on your age and phase of life. Before you do anything, research is key. Some people stress that they require a particular quantity of cash to invest prior to they can get aid from a professional.

A Biased View of Clark Wealth Partners

If you haven't had any experience with a monetary expert, right here's what to anticipate: They'll begin by giving a complete assessment of where you stand with your assets, responsibilities and whether you're meeting benchmarks contrasted to your peers for cost savings and retired life. They'll assess short- and long-lasting goals. What's helpful concerning this action is that it is individualized for you.

You're young and working complete time, have an auto or two and there are pupil car loans to pay off.

Some Known Details About Clark Wealth Partners

You can discuss the next ideal time for follow-up. Before you begin, inquire about rates. Financial experts usually have various tiers of prices. Some have minimal possession degrees and will certainly bill a cost commonly several thousand bucks for producing and readjusting a strategy, or they might charge a level fee.

You're looking in advance to your retirement and assisting your youngsters with greater education and learning prices. A monetary consultant can offer guidance for those circumstances and more.

Clark Wealth Partners Fundamentals Explained

That might not be the best method to check maintain building wide range, specifically as you advance in your profession. Schedule routine check-ins with your coordinator to modify your strategy as needed. Stabilizing cost savings for retirement and university costs for your children can be tricky. An economic expert can help you prioritize.

Considering when you can retire and what post-retirement years might resemble can produce worries concerning whether your retired life savings remain in line with your post-work plans, or if you have actually saved enough to leave a tradition. Aid your monetary expert comprehend your strategy to cash. If you are extra conventional with conserving (and potential loss), their suggestions should react to your worries and worries.

The Ultimate Guide To Clark Wealth Partners

Intending for health and wellness care is one of the big unknowns in retired life, and a monetary specialist can describe options and suggest whether additional insurance coverage as security may be helpful. Before you start, attempt to obtain comfortable with the concept of sharing your whole economic photo with a specialist.

Providing your specialist a complete image can aid them produce a strategy that's prioritized to all components of your economic standing, especially as you're rapid approaching your post-work years. If your finances are basic and you have a love for doing it yourself, you might be fine on your own.

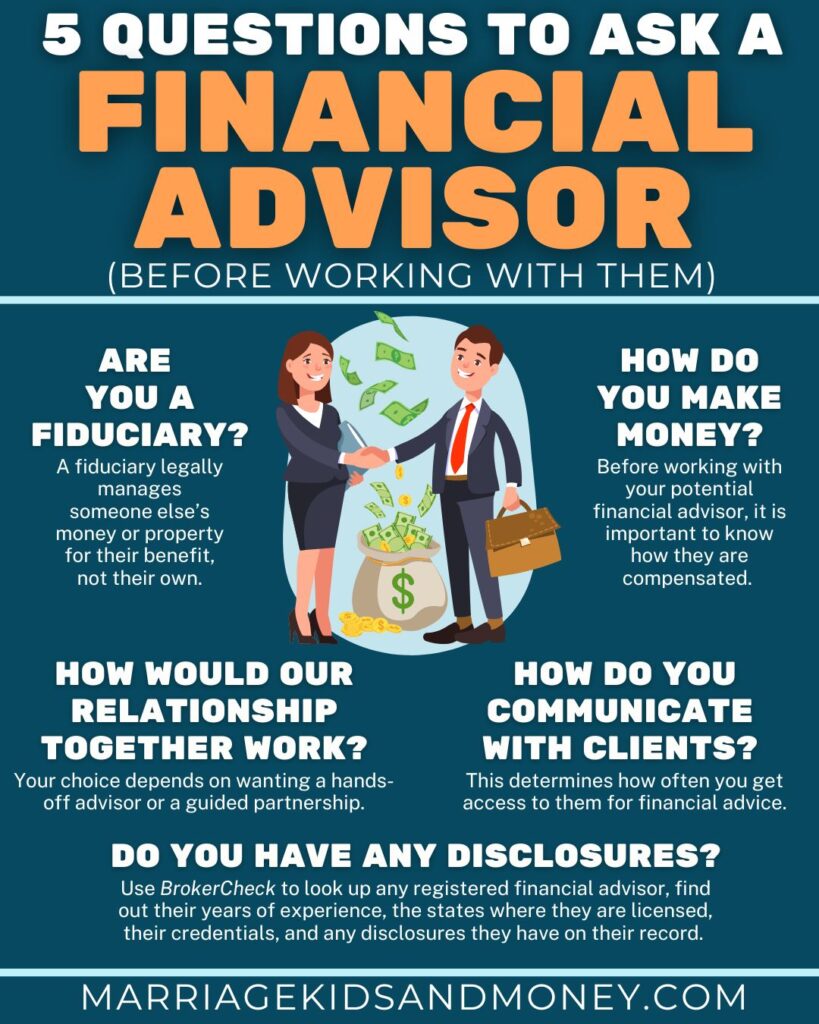

A financial consultant is not only for the super-rich; anyone facing significant life changes, nearing retirement, or feeling overwhelmed by financial decisions could take advantage of professional advice. This short article explores the duty of financial advisors, when you might require to seek advice from one, and crucial considerations for selecting - https://clrkwlthprtnr.carrd.co/. A financial consultant is a skilled expert that assists customers handle their funds and make educated decisions that line up with their life objectives

Clark Wealth Partners Can Be Fun For Everyone

In contrast, commission-based advisors make income via the economic products they offer, which may influence their referrals. Whether it is marital relationship, divorce, the birth of a youngster, job adjustments, or the loss of a liked one, these occasions have special financial effects, typically needing prompt choices that can have long-term effects.